Call experts

(780) 803 - 8115

Call experts

(780) 803 - 8115

We know most people will make it to retirement without suffering a major illness but if you are one of the unlucky ones, what happens now?

Would you forego 1% of your annual rate of return to eliminate this risk?

Sure, you could use your savings or take out a loan to cover the unexpected costs, however, both options will have a significant impact on your retirements plans. If you need to access your registered funds, they are taxed in the year you use them. Accessing those funds prior to retirement is not part of your plan.

Pass on that risk to an insurance company. They will take care of the rest with an illness recovery benefit. This is a tax-free lump sum payment to cover any number of unforeseen expenses. No need to submit receipts or to justify the costs.

If you are diagnosed and survive a major illness like cancer, heart attack or stroke, you receive an illness recovery benefit payment. This will keep your retirement goals on track.

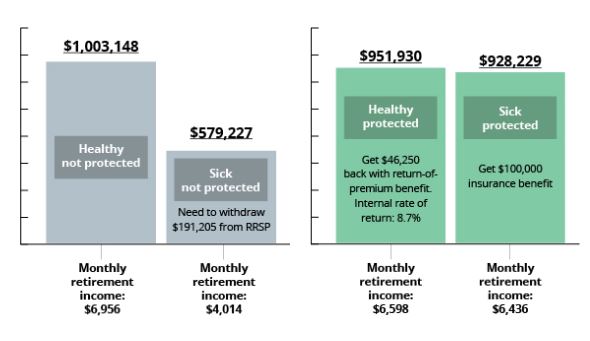

Below is an example of a typical 40-Year-old, on track, saving for retirement.

After diagnosis, he/she needs to access 100k from their registered account at age 55 to cover additional costs associated with fighting an unfortunate cancer diagnosis. The impact is significant:

Take 1% of your annual rate of return to pay the premium. Your future self and family will be grateful if the worst happens.

All Rights Reserved © 2024 Protect Lives

Crafted by: New Marketing Revolution Inc.